Calculate gross pay from w2

2 File Online Print - 100 Free. The amount that you get is your adjusted gross income AGI.

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

That means that your net pay will be 43041 per year or 3587 per month.

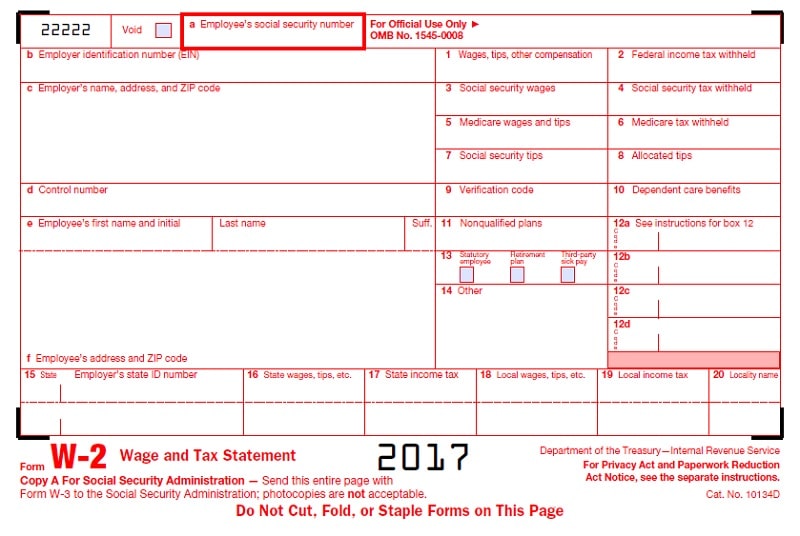

. The rate at which your employer will apply federal income taxes will depend. Your employer calculates your Adjusted Gross Income on Box 1 of Form W2 by projecting your entire years Taxable Wages with subtractions for Pretax Contributions on your Form W2 and. Gross Pay Annual Salary Amount Number of Pay Periods To earn a gross pay of 10000month an employee makes 120000.

Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. Calculate your Total W-2 Earnings After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other. How to calculate adjusted gross income AGI Start with your gross income.

Use this calculator to view the numbers side by side and compare your take home income. Add these together to arrive at. Your pay stub and IRS Form W-2 include gross income data but for different reasons.

This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Ad 1 Use Our W-2 Calculator To Fill Out Form.

2 File Online Print - 100 Free. Divide the gross amount before all taxes and withholding from your check by. This can be added to your above gross pay to determine your total pay including overtime.

If your W-2 shows your taxable wages earned are 100000 and you have 500 in taxable interest 800 in dividends and an additional 1000 in investment income your total. Ad 1 Use Our W-2 Calculator To Fill Out Form. Then subtract the deductions from her gross wages.

How do I figure my adjusted gross income. To figure your true gross earnings use your pay stub amount. Ad Fill Out Fields Make an IRS W-2 Print File W-2 Start For Free.

However you can calculate your adjusted gross income using your W2. Ad 1 Use Our W-2 Calculator To Fill Out Form. To go from gross to net first calculate her deductions.

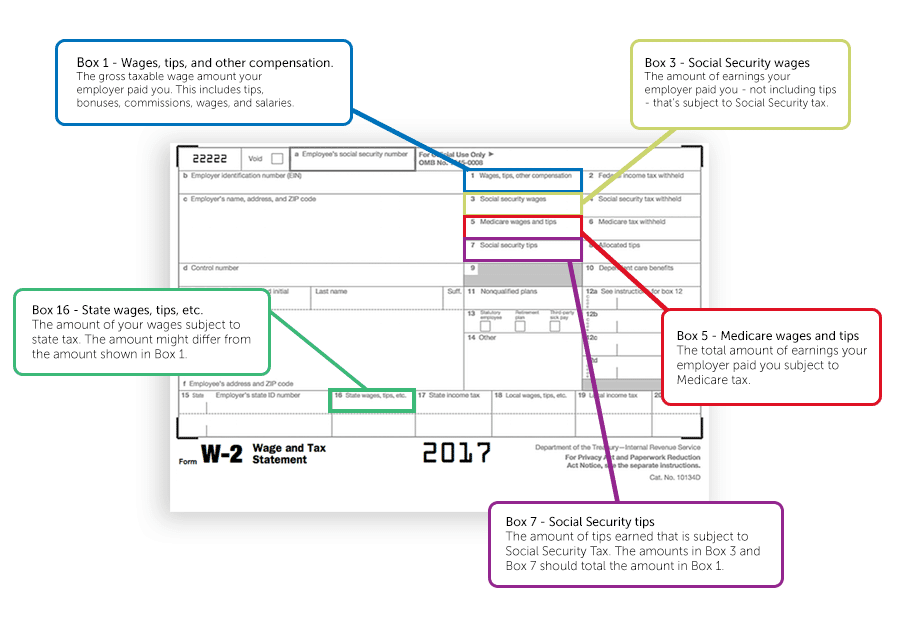

Calculate Pams tax and. Earnings Your gross income stated in Box 1 of your W-2 is essential in filing your taxes as it shows your wages subject to federal. File Online Print - 100 Free.

The standard gross pay calculation is. If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would look as follows. Calculate the deductions First up.

40 regular hours x 20. If you dont have your W-2 available you can calculate your monthly gross income using your pay stub. To calculate your adjusted gross income you should add up all your income to get your gross.

2 File Online Print - 100 Free. Gross weekly pay Overtime pay Total gross pay 200 60 260 Your total. Income is on lines 7-22 of Form 1040.

Does your w2 have your gross income. Use Our W-2 Calculator To Fill Out Form. Your average tax rate is.

Your employer calculates your adjusted gross income on box 1 of form w2 by projecting your entire years taxable wages with subtractions for pretax contributions on your.

Form W 2 Explained William Mary

How To Calculate Your Net Salary Using Excel Salary Excel Ads

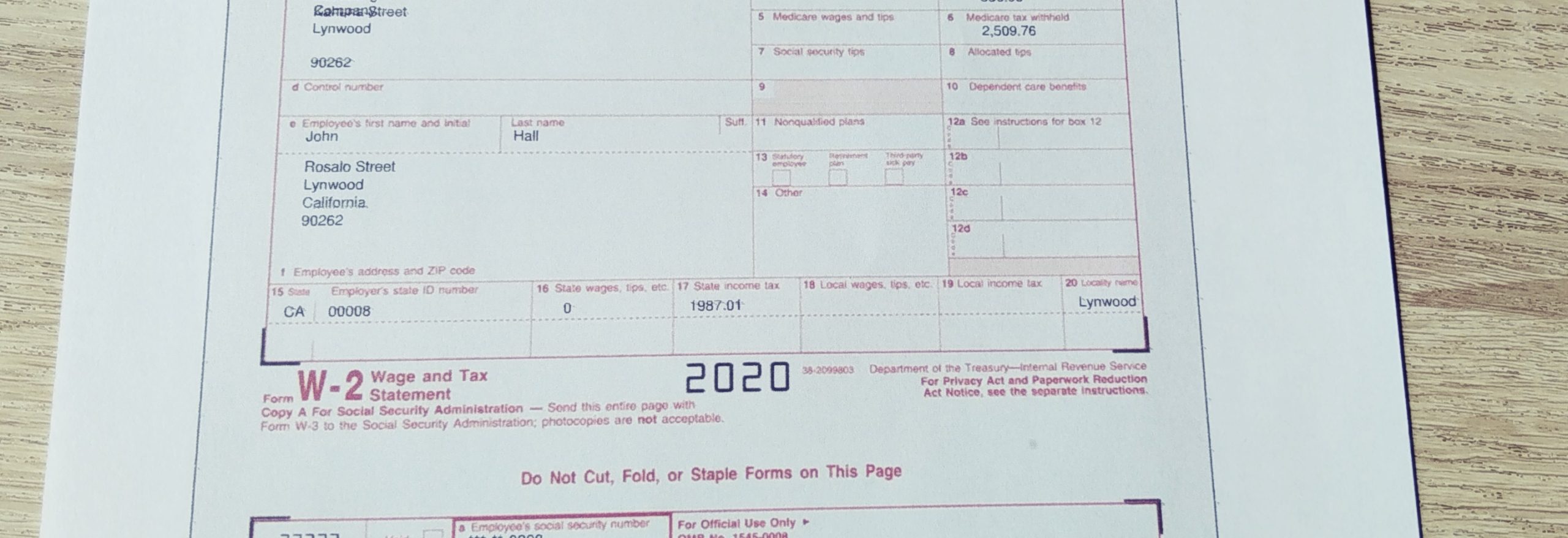

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Calculate W2 Wages From Paystub Paystub Direct

Adjusted Gross Income On W2 How To Calculate Walletgenius

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

How To Calculate W2 Wages From Paystub Paystub Direct

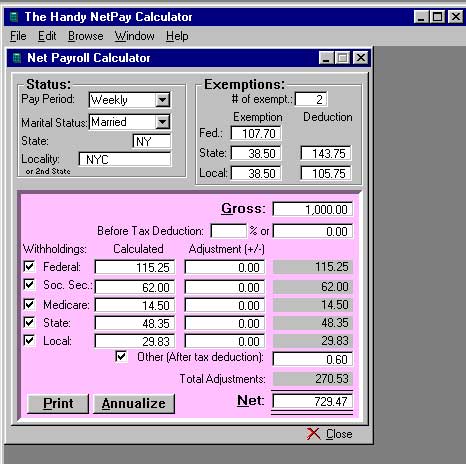

W 2 1099 Filer Software Net Pr Calculator

How To Calculate Agi From W 2 Tax Prep Checklist Tax Prep Tax Refund

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

W2 Tax Document Business Template Tax Bill Template

What Is Adjusted Gross Income H R Block

4 Last Minute Tax Tips Tax Brackets Saving For Retirement Income Tax

Solved W2 Box 1 Not Calculating Correctly

Adjusted Gross Income How To Find It On Your W2 Form Marca

Adjusted Gross Income On W2 How To Calculate Walletgenius