Peg ratio calculator

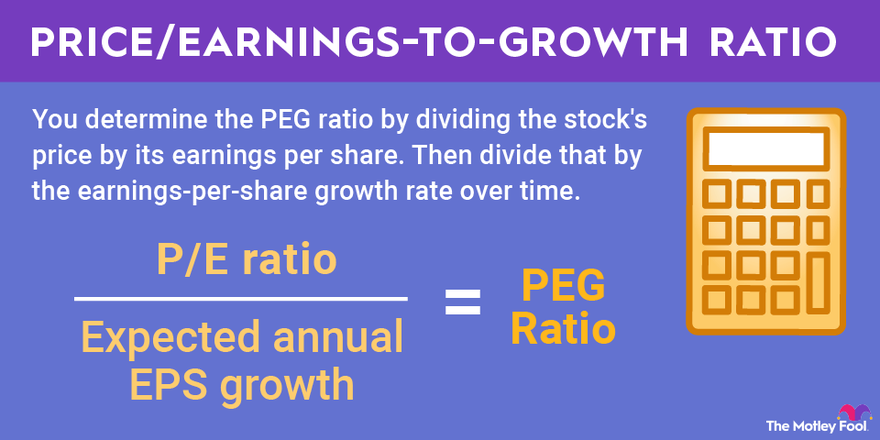

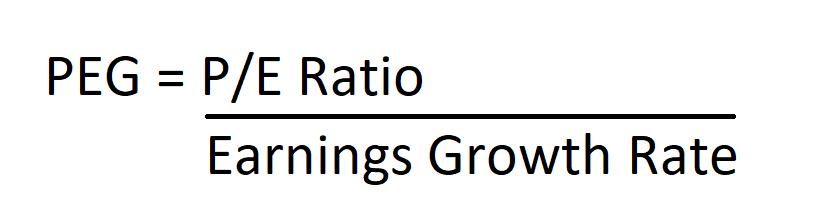

One simply divides a companys PE ratio by its expected rate of growth. Formula to calculate PEG ratio is given below.

What Is The Peg Ratio

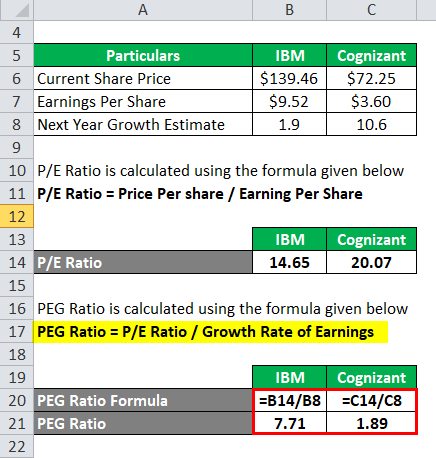

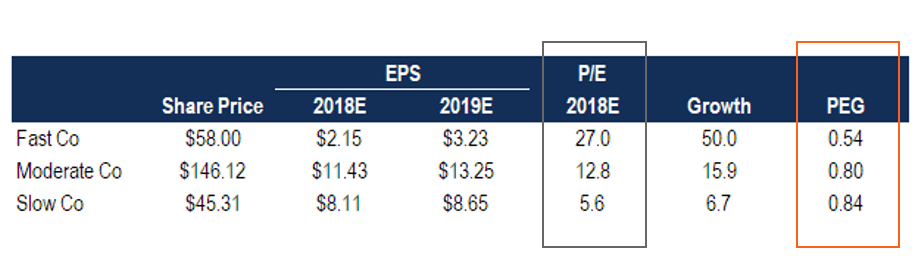

PEG ratio stock A 2018 111 PEG ratio stock B 2530 083 From these values it can be concluded that while stock A had a lower PE ratio the market still overestimated its earning.

. The PEG ratio formula is shown below. How Does PEG Ratio Calculator Work. To calculate the PEG ratio of a given stock divide the.

The PEG ratio is a valuation metric used to determine the value of a stock based on its current earnings and future growth. Enter a companys current trading price its 12 month earnings and its earnings growth rate to compute its PEG. The priceearnings to growth ratio PEG ratio is a stock price-to-earnings PE ratio divided by the growth rate of its earnings for a specified time period.

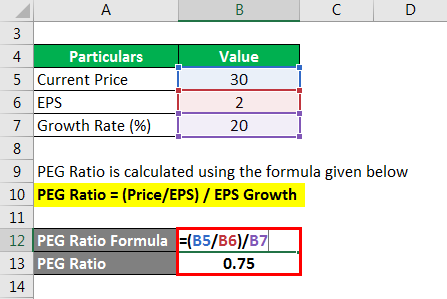

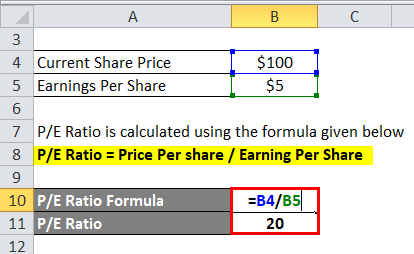

What the PEG ratio doesnt take into account is the dividend yield. PE Ratio 60210 2857. PriceEarnings-to-Growth PEG Ratio Calculator Price to Sales PS Ratio Return Capital Gains Yield CGY Calculator Holding Period Return HPR Calculator Real Rate of Return Calculator.

PEG ratio PE ratio earnings growth rate. PriceEarnings-to-Growth PEG Ratio. A company with a PE.

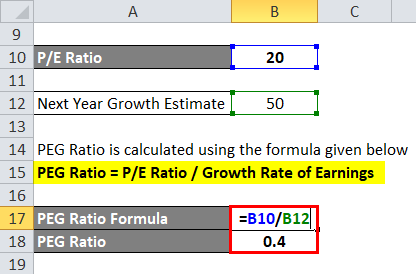

The price-to-earnings-to-growth PEG ratio is a formula that compares a stocks price to its earnings and rate of growth. A ratio between 5 and less than 1 is considered good meaning the stock may be undervalued given. Calculate the PEG ratio Finally we can calculate the PEG ratio given the information we have.

Below is a PEG ratio calculator or price to earningsgrowth ratio calculator. How to calculate the PE ratio. The formula for the peg ratio is derived by dividing the stocks price to earnings p e ratio by the growth rate of its earnings for a specified time period- peg.

Why Use PEG Ratio Calculator. Then he calculates the. How do you calculate priceearnings-to-growth ratio.

In the below PEG calculator enter the PE ratio and annual EPS growth and click calculate button to find PEG ratio. PEG Share Price Earnings per share Earnings per Share growth rate Example of the PEG Ratio Calculation Using the example shown in the table at the top of this guide. Has a PE ratio of 20 calculated by comparing ABC Corps stock price against its total earnings per share.

To calculate the PEG ratio the investor first calculates the PE ratio. A Sample PEG Ratio. The math behind the PEG ratio is straightforward.

The PEG formula consists of calculating the PE ratio and then dividing it by the long-term expected EPS growth rate for the next couple of years. Suppose that ABC Corp. The PEG ratio is calculated by dividing the price to earnings per share ratio by the earnings per share growth forecast.

The investor carries out the same procedure for this company. How to Calculate the PEG Ratio. A PEG ratio of 1 theoretically indicates that the stock is fairly priced.

Peg Ratio Example Explanation With Excel Template

What Is Peg Ratio Quora

Peg Ratio Breaking Down Finance

Peg Ratio Formula How To Calculate Price Earnings To Growth

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Peg Ratio Definition Equation Calculation

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Price Earnings Growth Ratio What It Really Means

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Definition Formula Seeking Alpha

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Example Explanation With Excel Template

Peg Ratio Price Earnings To Growth Formula And Calculator Excel Template

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Formula How To Calculate Price Earnings To Growth

Value Stocks Finvestable